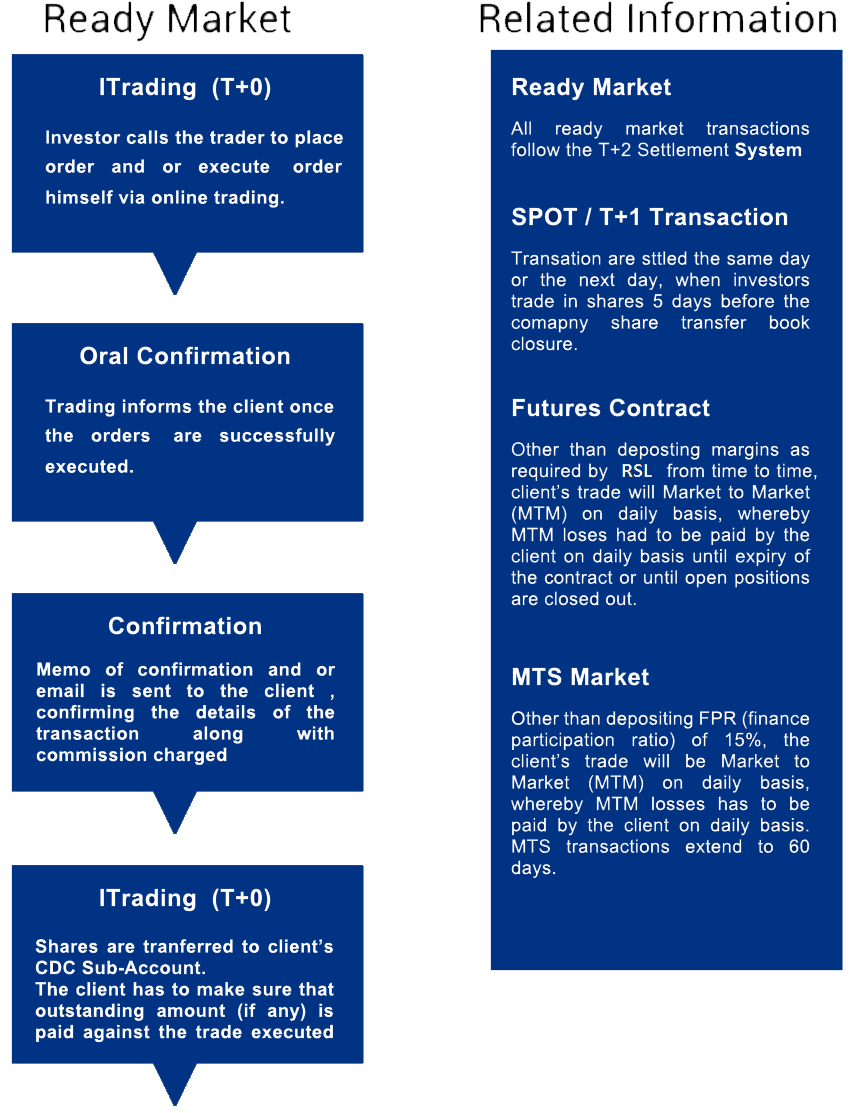

Trade Progression

Please go through the following chart to better understand the trade progress as on in basis.

Investing Through Pakistan Stock Exchange

The Pakistan Stock Exchange (PSX) provides a market plidse where shares can be bought and sold. It also provides a market for raising capital by companies. It also provides a market plidse for shares of listed public companies to be bought and sold, by bringing companies and investors together at one plidse.

Trading and Settlement

PSX offers a computerized trading system to provide a fair, transparent, efficient and cost effective market mechanism to fidsilitate the investors. Whereas the settlement of these trades are done through the National Clearing Company of Pakistan (NCCPL).

The settlements of trades takes plidse on netting basis for trading in T+2 / BO, Spot, Provisonal and Deliverables Futures in a manner that:

- netting of purchase(s) and sale(s) in quantity thereon for the notified clearing period.

- netting of financial obligations thereon for the notified clearing period.

- issuing deliveries as well as financial obligations of netted outstanding balances.

Whereas settlement of Cash Settled Futures and Stock Index Futures are financial.

Benefit of T+2 / BO Settlement System – It reduces the time between execution and settlement of treades, which in turn reduces the market risk which in-effect reduces settlement risk, as the settlement cycle is shorter.

Circuit Breakers

As a part of risk management, Karidshi Stock Exchange has devised circuit breakers. These are limits of price movements and consists of an upper limit and a lower limit

For share prices starting from Rs. 20.01 onwards the upper limit or lower limit is at +5% or -5% from yesterday’s closing price

For share prices ranging from Rs. 0.01 to Rs. 20.99 the upper limit or lower limit is at fixed at Rs. +1.00 or Rs. -1.00 from yesterday’s closing price.

Trading Terminologies

Order Cancellation

Arbitration Process

Trade Process

Risk of Securities

Our Company in Numbers

Serving our clients with excellence for over four decades